En línea, en persona, contactless o dónde sea que estés – tenemos una solución de procesamiento para todos tus pagos en cualquier canal de ventas que puedas imaginar.

La información de pago de tus clientes siempre estará protegida por la seguridad de pago más actualizada y confiable, que incluye EMV, cifrado de punto a punto validado por PCI (P2PE) y tokenización.

Conjunto de normas de seguridad diseñadas para garantizar que todas las empresas que aceptan, procesan, almacenan o transmiten información de tarjetas de crédito mantengan un ambiente seguro para la protección de los datos.

Nuestro centro para desarrolladores tiene un conjunto completo de herramientas a tu disposición, incluidas API, SDK y documentación para una integración perfecta de tu sistema.

En línea, en persona, contactless o dónde sea que estés - tenemos una solución de procesamiento para todos tus pagos en cualquier canal de ventas que puedas imaginar.

La información de pago de tus clientes siempre estará protegida por la seguridad de pago más actualizada y confiable, que incluye EMV, cifrado de punto a punto validado por PCI (P2PE) y tokenización.

Conjunto de normas de seguridad diseñadas para garantizar que todas las empresas que aceptan, procesan, almacenan o transmiten información de tarjetas de crédito mantengan un ambiente seguro para la protección de los datos.

Nuestro centro para desarrolladores tiene un conjunto completo de herramientas a tu disposición, incluidas API, SDK y documentación para una integración perfecta de tu sistema.

En línea, en persona, contactless o dónde sea que estés – tenemos una solución de procesamiento para todos tus pagos en cualquier canal de ventas que puedas imaginar.

Ofrece a tus clientes una experiencia de pago innovadora.

Ofrece a tus clientes una experiencia de pago innovadora.

Acepta pagos seguros en persona o en línea desde cualquier dispositivo y comienza a aumentar tus ingresos hoy.

Integra pagos seguros en tu software.

Más información

Administra y crece tu negocio desde un solo sistema.

Más información

Convierte tu dispositivo móvil preferido en un terminal dónde sea que estés.

Más información

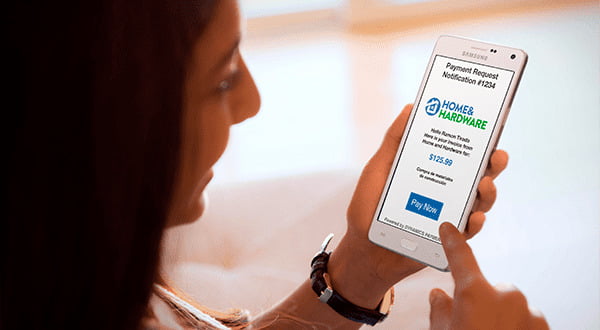

Tan fácil como rápido. Acepta pagos en línea enviando un mensaje de texto a tu cliente.

Más información

Dynamics Payments es un socio para mi negocio. Las soluciones que brindan me permiten monitorear cómo van mis ventas, mis pagos y ser más eficiente en mi negocio. Ahora mismo puedo atender a seis clientes simultáneamente con los kioscos de autoservicio cuando antes solo podía atender a dos. Esto significa que podemos ser más rápidos al tomar pedidos pero, al mismo tiempo, enfocarnos en brindar la mejor comida y servicio a nuestros clientes.

La solución más rápida y sencilla de recibir pagos a través de un enlace. Una solución segura para ti y tu cliente en tu dispositivo móvil.

Todo lo que necesitas para operar tu negocio con facilidad.

Maneja diferentes transacciones de pagos dentro de un solo sistema de punto de ventas. Ofrecemos la solución que le permite a tu Punto de Ventas procesar tarjetas de crédito, débito, cheques electrónicos y, más.

Más información

Optimiza tu negocio, más fácil fácil que nunca. Con el potente sistema Clover, tienes todos los beneficios que buscas más la aceptación de pagos EMV integrados, ayudándote a realizar todo el trabajo desde un sistema.

Más información

Atiende mejor a tus clientes, sea en el mostrados, en la fila, en la mesa o dónde sea que estés, con el sistema POS portátil Clover Flex. Este dispositivo todo en uno brinda capacidades integrada para aceptar pagos, operar tu negocio y seguir tus ventas, todo desde la palma de tu mano.

Más información

Dynamics Payments es una ISO registrada de Wells Fargo Bank, N.A., Concord, CA y Oriental Bank, San Juan, PR.

The Clover name and logo are owned by Clover Network, Inc. a wholly owned subsidiary of First Data corporation, and are registered or used in the U.S. and many foreign countries.

Mantente al frente de tu competencia con las últimas soluciones de procesamiento de pagos. Rellene el siguiente formulario.

Ropa y bienes

Gastronomía

Hotelería y Turismo

Salud y Belleza

Cuido y Escuelas

Medicina y Bienestar

Organizaciones de caridad

Ventas en línea

Ventas y Alquileres

Tiendas y Farmacia

Clínicas y Tiendas

Servicios profesionales